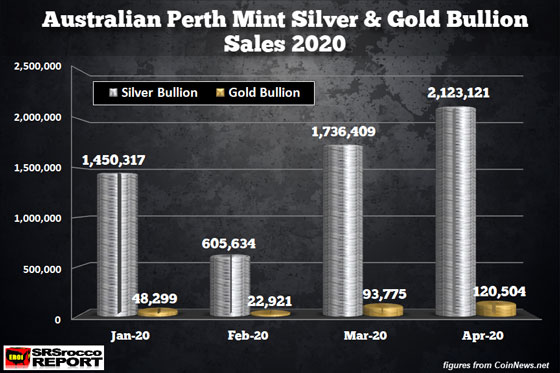

Due to investor fears stemming from the global contagion, demand for Perth Mint silver and gold bullion products surged in April. According to CoinNews.net, the Perth Mint’s gold bullion sales in April were the highest since the website started collecting data in February 2013, while silver bullion sales were in second.

The Perth Mint gold bullion bar and coin sales reached 120,504 troy ounces in April, while silver bullion sales were 2.1 million oz. Thus, the Perth Mint sold 17 times more silver bullion than gold last month. Figures in the chart below are shown in troy oz.

For the first four months of the year, the Perth Mint sold 5.9 million oz of silver bullion products and 285,500 oz of gold bullion. Compare that to the total U.S. Mint Silver Eagles sold during the same period of 10.7 million and 323,500 oz for Gold Eagles.

It will be interesting to see what the level of gold and silver bullion products will be for the rest of the year as investors become more concerned about the financial system as the Fed and central banks continue printing money hand-over-fist.

In 2019, the total investment in silver billion demand was 186 million oz (Moz), according to the data in the Silver Institute’s 2020 World Silver Survey. The highest physical silver investment demand reached was 300 Moz in 2013, due to the huge sell-off in the silver price.

I believe the only way for physical silver investment demand to overwhelm the market would be something north of 500 Moz in a year. Maybe even 600 Moz. However, I believe that won’t be that much of an issue when just 1% more of investors decide to purchase physical silver investment.

About the Author:

Independent researcher Steve St. Angelo started to invest in precious metals in 2002. In 2008, he began researching areas of the gold and silver market that the majority of the precious metal analyst community has left unexplored. These areas include how energy and the falling EROI – Energy Returned On Invested – stand to impact the mining industry, precious metals, paper assets, and the overall economy.