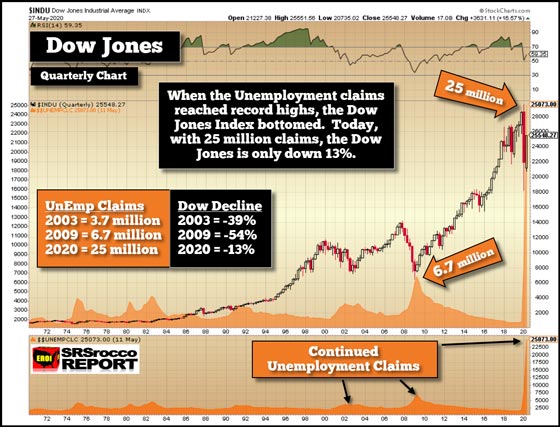

It’s no surprise to most investors that the Fed is propping up the stock market. However, if we compare the Dow Jones Index versus the continued unemployment claims, something seriously wrong is going on. According to the St. Louis Federal Reserve, continued unemployment claims are nearly four times higher than the peak reached in June 2009.

When the continued unemployment claims reached a peak in 2009, the Dow Jones Index had fallen 54% from its highs in 2007. On the other hand, today, with 25 million Americans receiving unemployment insurance, the Dow Jones is only down 13% from its high.

The continued unemployment claims are shown in both the bottom of the chart and also behind the Dow Jones Index candlesticks. As the unemployment claims reached peaks, in 2003 and 2009, the Dow Jones Index bottomed. I can assure you the HUGE RED CANDLESTICK with the wick nearly reaching down to the 18,000 level, wasn’t a BOTTOM. Bottoms, shown in the past, last 2-3 quarters.

Furthermore, the continued unemployment claims are nearly FOUR TIMES higher than they were in 2009. Thus, the Dow Jones Index should fall even lower in percentage terms. As shown in the chart above, the Dow Jones Index fell 54% from its high. For the Dow Jones Index to hit the same percentage low, it would have to fall to 13,750. So, the 18,000 level wasn’t the low for the Dow Jones.

Sure, the Fed will continue printing money to prop up the stock market and economy, but at some point, GRAVITY and the LOUSY FUNDAMENTALS will kick in.

I stated that I would put out a new video over the weekend, but due to research in other projects, I will try to get it out in the next 1-2 days. I will show that it wasn’t any COINCIDENCE that the Dow Jones Index corrected near the 18,000 level.

Regardless… there’s a lot of damage continuing to take place in the economy that will only make matters worse in the second half of the year. Even though Americans are now driving more, going back to work, restaurants, and shopping… the economy is seriously broken. It will likely never return to the same level we enjoyed last year.

About the Author:

Independent researcher Steve St. Angelo started to invest in precious metals in 2002. In 2008, he began researching areas of the gold and silver market that the majority of the precious metal analyst community has left unexplored. These areas include how energy and the falling EROI – Energy Returned On Invested – stand to impact the mining industry, precious metals, paper assets, and the overall economy.