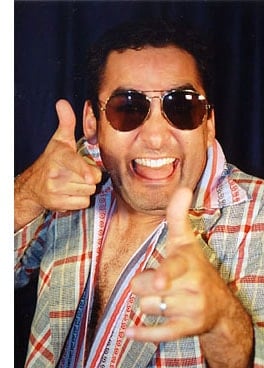

Regal Assets, a somewhat prominent gold and silver dealer in southern California, is in serious trouble based on news released last week. Tyler Gallagher, the firm's high-flying owner, has reportedly vanished... perhaps to avoid arrest and prosecution.

Regal clients are now talking to the press about their inability to get delivery of the metal they bought and paid for. The Regal website has been taken offline.

As reported in the Daily Beast article titled The Great Gatsby of Gold Took Their Millions – and Vanished, those contacted by the reporter all told a similar story of their interaction with Regal Assets: "an enthusiastic sales pitch, a six-figure investment, months of delays and excuses, and finally, over the summer, radio silence."

If you get a high-pressure pitch for

"rare," graded, or proof coins, RUN!

Over the years, Regal Assets was one of the many firms that heavily promoted so-called "collectibles" and proof coins rather than bullion. That was always a major red flag in and of itself.

As we've reported many times here at Money Metals, firms that pressure investors to buy these high-premium and "graded" products should be avoided. In this case, poor ethics has given way to business failure, if not outright theft.

Like banking, investment, and crypto markets, the gold and silver markets attract a lot of money. And that money attracts some bad actors and fraud.

As with any investment, it is incumbent on buyers and sellers to pay attention and be careful about with whom they do business. This has never been truer than today.

The institutions people rely on to clean up the markets are unreliable – largely because government regulation doesn't tend to work in the first place. Regulators usually arrive on the scene after the damage is already done.

Honest companies don't need regulation to do the right thing. Dishonest companies don't care much about the law.

At Regal Assets, Gallagher exploited people's faith in institutions like Forbes and Rolling Stone. He was able to join the Forbes Finance Council by doing little more than declaring the size of his business and paying a sizable membership fee.

Joining the Council meant being able to advertise his firm as a member and publish articles under the Forbes imprimatur.

It is easy to assume membership and some by-lines at Forbes means more than it does.

It is not hard for unethical people to purchase a thin veneer of respectability. There are even private, for-profit, online review websites that very aggressively market reputation management services to businesses.

Regal Assets itself was a master at affiliate marketing, compensating scores of online marketers to spin up "review" sites that pooh-poohed legitimate businesses and pointed readers instead to Regal Assets. (In fact, Money Metals once had to take legal action against a Regal Assets affiliate illegally trading on our good name.)

Size and longevity offer limited assurance to investors as well. Mega-banks like JPMorgan Chase and Wells Fargo have been around for more than 100 years and have millions of clients. But these institutions have their rap sheets for swindling people in various ways.

Bullion investors have to judge a dealer for themselves. Reading customer reviews at the Better Business Bureau, which is a not-for-profit, is generally worth doing.

Look for a pattern of BBB complaints that indicate a company either isn't shipping at all or shipping after a delay that is much longer than expected.

Virtually all of the dealers which failed in recent years exhibited this pattern in advance.

It's also a good idea to call prospective dealers and evaluate how you are treated.

Does a live person answer the phone? Did a highly commissioned salesperson give you an aggressive pitch? Did they recommend high-margin collectibles or something other than low-price bullion coins, rounds, and bars? Are the answers to your questions straightforward and direct?

Trust is a precious commodity, and it seems to be evaporating quickly in this era of institutional failure. Be careful where you place yours.

About the Author:

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named "Best in the USA" by an independent global ratings group. A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals' brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.