The U.S. economy has just reached an alarming milestone with inflation hitting 3,000 percent under the Federal Reserve.

This high inflation rate has been exacerbated by the pandemic recession and subsequent actions, which saw the highest unemployment rate since World War II and the highest inflation rate in four decades.

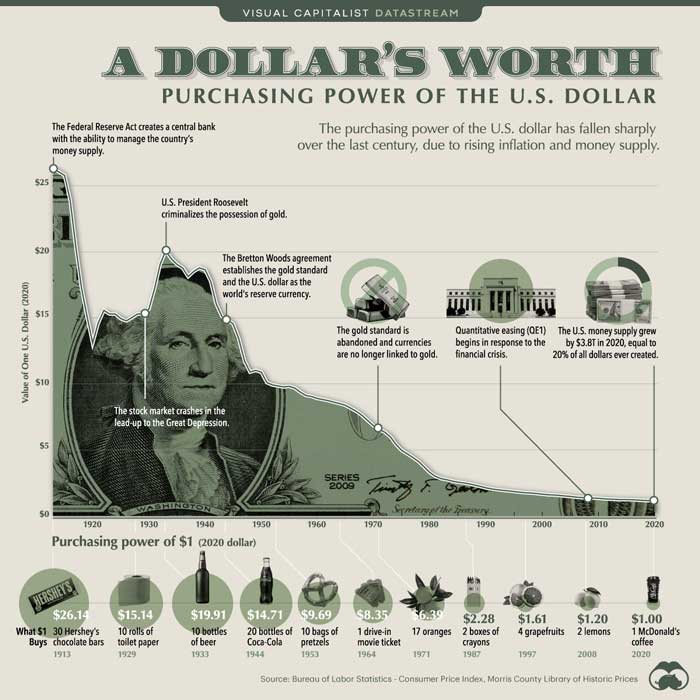

The Federal Reserve Act was passed in 1913. And from 1914 through 2022, the U.S. price level increased by 2,920.2 percent. Adding data from the first half of 2023, which showed a 2.74 percent increase in the Consumer Price Index, brings the total inflation rate under the Fed to 3,000.2 percent!

This starkly contrasts with the relatively stable purchasing power of the dollar in the 130 years before the Fed's existence, where inflation was nearly zero percent compared to the significant inflation experienced in less than 110 years under the Fed.

This means the purchasing value of your dollar has lost over 3000%.

Let that sink in for second...

While the government and news media wants you to think inflation is at only 7%, the reality is much different.

The purchasing power of a currency is the amount of goods and services that can be bought with one unit of the currency.

For example, one U.S. dollar could buy 10 bottles of beer in 1933. Today, that does not cover the cost of a small McDonald’s coffee. In other words, the purchasing power of the dollar—its value in terms of what it can buy—has decreased over time as price levels have risen.

We find ourselves standing at a pivotal juncture. The prospect of homeownership has become an unattainable dream for the average individual. Rent prices have surged to unprecedented heights, forcing younger generations to share their living spaces with roommates just to stay afloat.

General needs likes gas, food, and electricity have become much more expensive just in the last few years. Much of the younger demographic is grappling with the harsh reality of moving back in with their parents due to the astronomical increase in the cost of living since the onset of the COVID-19 pandemic.

Over the past quarter-century, my consistent message to all of you is now unfolding before our eyes. The value of the dollar has dwindled to the point of crisis, and it is clear that our government's actions have hastened its decline.

The historical track record shows that all fiat currencies eventually fail. When you entrust anything other than free markets to manage an economy, the result is an astonishing 100% failure rate.

The current state of our currency and economic system underscores the importance of understanding the dynamics at play and the potential consequences of centralized control. As we navigate these challenging times, it is crucial to consider alternative approaches that prioritize stability, economic freedom, and the preservation of value.

What is happening right now is proof that our fragmented economy is at a crossroads. Too many will be left behind and lose a big part of their wealth, but you could weather the storm and possibly even thrive during these times. You just need to take action now!

One way, of course, is to diversify some of your savings into physical gold and silver. There are other approaches to consider too.

My newsletter, The Morgan Report, provides world-class analysts to help you build and secure your wealth.

Whether you’re new to investing or a seasoned professional, our independent and detailed analysts of these markets offer you a huge advantage when it comes to building and securing your wealth.

Click here to learn more -- and to protect and preserve your wealth!

David Morgan

The Morgan Report Founder

About the Author:

A widely recognized expert on silver, David Morgan began investing in stocks and precious metals as a teenager. He obtained degrees in finance and economics as well as engineering. Author of the book The Silver Manifesto, he has devoted more than 30 years to educating investors on opportunities to protect and grow their wealth. In addition to advising private clients and fund managers, he writes at The Morgan Report, covering economic news, the global economy, currency debasement, and stellar opportunities in precious metals and mining stocks.