The bullish case for silver and silver investments could not now be clearer, and this being so it won’t take long to set it out.

We’ll start with the very long-term 20-year chart which makes it crystal clear what is going on. On this chart we see that a huge and magnificant Cup & Handle base has built out in silver over the past 11 years and the pattern is now complete – meaning that breakout is likely imminent, which is hardly surprising given how gold, shown at the top of this chart, has already broken out into a major new bullmarket and is romping ahead. The reasons for this – currency collapse and spreading wars - are not the subject of this article.

This is a good juncture to address the issue of how, in the early stages of a major sector bullmarket, gold and gold investments hog the limelight, usually leaving silver and silver investments to “bring up the rear”. This time round silver looks set to do a lot better in the early stages of this bullmarket – why? – because it is so horribly undervalued relative to gold, as the following long-term 20-year silver over gold chart makes clear…

Silver has a huge amount of catching up to do and once it breaks out above the resistance at the upper boundary of the Cup & Handle base pattern it is expected to race quickly towards its 2011 highs in the $50 area as an initial objective.

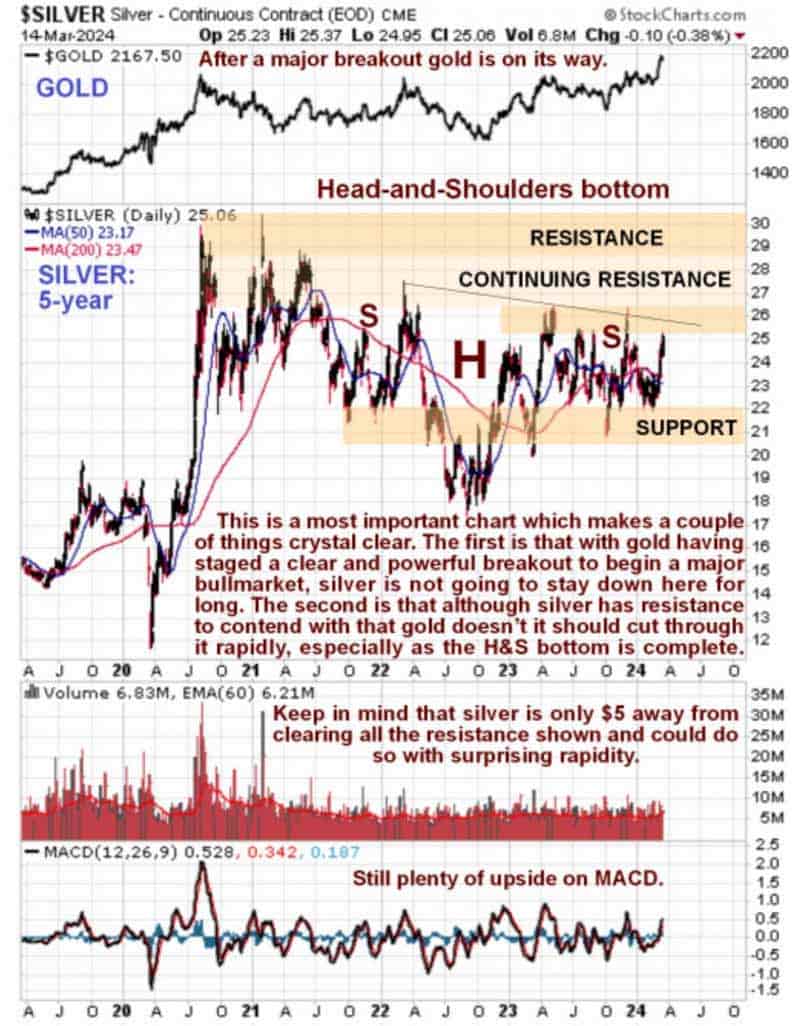

Zooming in via the 5-year chart enables us to examine the “Handle” part of the giant Cup & Handle base in more detail and thus see why silver has been dithering around somewhat this month on gold’s breakout and has comparatively speaking not done very well. The reason for this is easy to spot – unlike gold it has had a considerable amount of overhanging supply to work off before it breaks out of the base pattern, but that said its attacks on the $25 - $26 area over the past year or so have already chewed through a lot of it which means that, with would be sellers having second thoughts as gold continues to ascend, it could bust through the remaining resistance with surprising alacrity in the weeks to come and once it gets above the 2020 – 2021 highs in the $30 area it could accelerate dramatically.

So we should not be confused by the seemingly “random walk” meanderings that we see on the shorter-term 6-month chart whose main use it to show us gold’s much stronger performance this month and how any further significant gains by silver will quicky lead to its moving averages swinging into strongly bullish alignment.

The conclusion is that time is fast running out to buy silver and silver related investments at the current bargain basement prices and that if you are minded to do so, you had better get on with it.

We will be looking at a range of large and mid-cap silver stocks soon on the site, to complement the range of large cap gold stocks that we looked at last weekend.

About the Author:

Clive P. Maund is a longtime trader who has provided professional chart analysis for over a decade, covering a wide range of markets with a special focus on the resource sector. In addition to his decades of trading experience and financial research, Clive obtained a UK Society of Technical Analysts diploma. His website is CliveMaund.com.