Holding fiat currency is risky business and that’s not going to change any time soon.

Currency risk is one of the factors driving the recent rally in gold and silver. It’s no coincidence that the recent gold and silver rally started as the U.S. ramped up threats to seize Russian dollar assets.

However, using the dollar as a foreign policy hammer is just one of many threats to the stability of the U.S. currency, and these currency risks are inherent in all fiat currencies.

Fiat Currencies are Inherently Risky

Risk is inherent to any fiat money system because governments and central banks always cave to the temptation to inflate the currency. This leads to constant devaluation of the money manifesting in price inflation. It also causes economic distortions, incentivizes debt, and fuels boom-bust cycles.

Because fiat money has no physical backing, central banks can create money without limits to enable government spending.

They can’t resist.

Government and central bank money creation enables politicians to spend more than they otherwise could on both domestic programs and foreign adventures. Spending is political power. Nobody wants higher taxes, but virtually everybody wants more government programs to address this or that problem. By delivering these programs, whether the government can afford them or not, politicians buy votes.

In other words, political systems provide virtually no incentives for fiscal restraint. Politics encourages politicians to spend and kick the debt problem down the road for somebody else to worry about.

And since central banks (essentially an arm of the government) can create more money – they will.

This becomes even more evident during an “emergency.” A crisis provides an excuse to throw all caution to the wind. The Covid-19 pandemic provides a perfect example. In just two years, the Federal Reserve created nearly $5 trillion out of thin air and monetized virtually all of the government debt issued during that time. Other central banks around the world followed suit.

As long as governments have access to a money printing press, they will use it. That means fiat systems will always feature currency risk.

Spending Leads to Debt

The spending incentives in a fiat monetary system lead to a secondary risk - unsustainable government debt.

Governments can kick the spending can down the road by borrowing more and more money. This is especially true of the United States because it issues the world reserve currency. That creates a global demand for dollars, allowing the Fed to print plenty of money to sustain the debt.

But every house of cards eventually falls.

That risk is currently exacerbated because government spending has blown through the roof.

Governments used the pandemic as an excuse to effectively hand out blank checks. Spending has come down since governments around the world shut down the economy, but it hasn’t returned to pre-Covid levels.

And it never will.

As economist Robert Higgs explained in his book Crisis and Levithan, there is a ratchet effect when it comes to government spending. A crisis provides the excuse to put spending on steroids. After the emergency passes, spending falls, but it never drops all the way back to pre-crisis levels. When the next crisis comes, the process repeats, with overall spending ratcheting upward each time.

In the United States, government spending now averages over half a trillion dollars every single month.

So far in fiscal 2024, the Biden administration has already blown through $2.12 trillion.

Spending is up 14.5 percent compared to the first five months of fiscal 2023. The U.S. now spends about twice what it takes in through taxes. And this is despite the [pretend] spending cuts and promises from the Biden administration that it would save “hundreds of billions” with the debt ceiling deal (aka the [misnamed] Fiscal Responsibility Act).

This underscores the point: no matter what you hear about spending cuts, the federal government always finds new reasons to spend more money.

Government spending creates more debt. More debt means more money creation. And as already discussed, money creation poses a risk to the stability of any currency.

The U.S. national debt currently sits at just over $34.5 trillion. But Uncle Sam isn’t the only one with a spending problem.

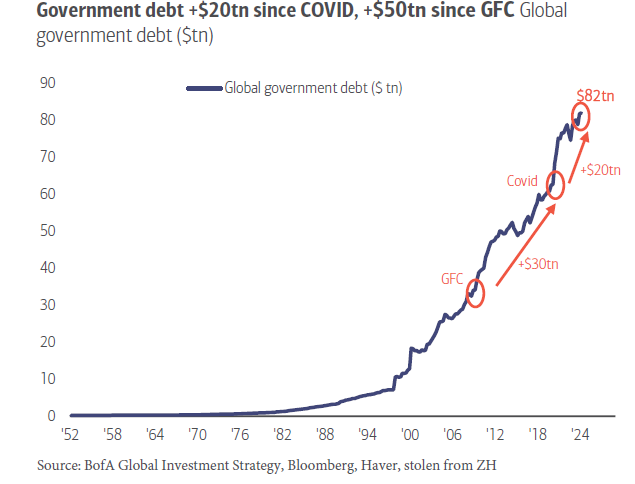

According to ZeroHedge, global government debt has risen to a record $82 trillion. That's up by $20 trillion since Covid.

BMO Capital Markets recently raised its price projection for gold. One of the reasons BMO analysts cited for their bullishness for precious metals is because they provide "a hedge against rising currency risks worldwide." As they noted, politicians aren’t going to suddenly become fiscally responsible.

“Given no politician is likely to be elected by promising to spend less in a year loaded with elections across key democracies, there is certainly a chance that later in the year we may see further currency concerns supporting precious metal performance as a new era of elevated fiscal spending across global economies gathers traction.”

This is one of the reasons central banks are buying gold.

Central bank net gold purchases totaled 1,037 tons in 2023. That fell just 45 tons short of 2022’s multi-decade record.

China was the biggest buyer in 2023. The People’s Bank of China officially reported a 225-ton increase in its gold reserves.

One of the stated reasons many central banks give for their recent gold buying spree is the desire to “diversify” their reserves. This is central bank-speak for minimizing their exposure to the dollar (and other fiat currencies) due to irresponsible fiscal policy in America, along with the U.S. government using its privilege as the issuer of the reserve currency to further its foreign policy aims.

As Bank of Poland President Adam Glapiński said, “Gold will retain its value even when someone cuts off the power to the global financial system, destroying traditional assets based on electronic accounting records.”

The World Gold Council said risk management was one of the key reasons some countries are turning to gold.

"Last year central banks placed great emphasis on gold’s value in crisis response, diversification attributes, and store-of-value credentials. A few months into 2024 the world seems no less uncertain meaning those reasons for owning gold are as relevant as ever."

One thing is certain: the value of the dollar (and all fiat currencies) will continue to fall. Even in the best of times, the Federal Reserve decreases your purchasing power by 2 percent annually as a matter of policy.

And these aren’t the best of times.

Despite the Fed’s best efforts to rein in price inflation, it remains sticky. Nevertheless, one of the factors driving the recent rally in gold and silver is anticipation of the end of the inflation fight. In other words, the markets are excited because the Fed may soon stop fighting inflation and go back to creating it.

Currency risk is one of the main reasons you want to hold real money – gold and silver. It can’t be printed and intentionally devalued by irresponsible governments. It is the ultimate hedge against currency risk.

About the Author:

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.