At Money Metals Exchange, we believe a significant part of our mission is to educate customers and the public at large about the many aspects of the precious metals market. While our precious metals specialists have the pleasure of addressing on an individual basis many excellent questions posed by our customers, we occasionally take the opportunity to address some of the best and most common questions in a more public way...

What Would a Modern-Day Currency Devaluation Actually Look Like?

Dick H. writes: It's nice to know someone out there cares enough to tell the other side. Thanks for all your information.

My question: How will the banking system work, what will it look like when, not if, we have a bank holiday? Businesses from mortgage to utilities companies are still going to want to be paid. Sure, one can write a check, but will the banks cash it? What will happen to direct deposit payroll checks and online bill pay? How long do you believe the bank holiday will last?

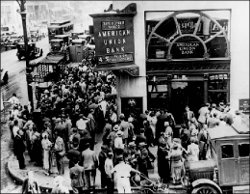

Let's look at precedent. In 1933, President Roosevelt declared a four-day bank holiday. This is what he had to say in a radio address on March 12, 1933:

"This bank holiday, while resulting in many cases in great inconvenience, is affording us the opportunity to supply the currency necessary to meet the situation... The new law allows the twelve Federal Reserve banks to issue additional currency on good assets and thus the banks that reopen will be able to meet every legitimate call. The new currency is being sent out by the Bureau of Engraving and Printing in large volumes to every part of the country. It is sound currency because it is backed by actual, good assets."

Today, of course, actual physical currency need not be printed and delivered to banks to bail them out. The Federal Reserve could, in theory, recapitalize all the banks instantaneously with a few computer entries, meaning checks wouldn't bounce and all electronic banking applications would continue to operate smoothly. Right now nobody seems to care that the Fed's electronic dollars are neither " sound" nor "backed by actual, good assets" – but one day people will.

If there is a sudden currency devaluation, the banks would need to re-stock branches and re-calibrate ATMs. There might be some disruptions in cash availability, but it wouldn't be a big deal logistically unless and until the devaluation spirals out of control, culminating in a run on the currency itself as the ultimate consequence of leveraging the currency's credibility beyond repair to avert bank runs.

Of course, the relative ease of logistics for banks and government central planners is one thing. The impact of a dollar devaluation on the public is quite another.

The cash you have in the bank, at home, etc. would instantly be worth a great deal less. Commerce would experience some disruption, and shortages would likely crop up. If you don't have a healthy stash of gold and silver bullion, you could face serious challenges. That said, if you have a great deal of debt (at fixed interest rates), you stand to benefit from dollar devaluation. Of course, the largest beneficiary would be the greatest debtor of them all -- Uncle Sam! That's why a devaluation of the dollar -- whether sudden and dramatic OR gradual -- is inevitable.

Sorting Through Your Best Coin Choices

Fred G. writes: Many dealers have their coins in Ag and Au; there are many varieties available – such as the Canadian Maple Leaf, Koala Bear, Austrian Philharmonic, American Eagle, etc. with a small to large difference in premium. For an investor, does it matter which type of coin you hold as long as they are 99% Ag or Au? When it comes time to sell, will there be a problem selling these generic types?

No, it doesn't matter much. Some people prefer to pay a little higher premium for government-minted coins that are more widely recognized. Perhaps recognizability could be important in person-to-person sales or barter transactions, where another party may be wary of accepting "generic" bullion. But coin dealers routinely handle bullion items of all types and won't hesitate to buy privately minted silver rounds and bars stamped ".999 fine."

When considering which type of gold bullion product to buy, purity isn't what counts. American Eagles and South African Krugerrands are alloyed with other metals for hardness. Gold by itself is soft and pliable. While you can opt for pure gold via Canadian Maple Leafs or privately fabricated rounds or bullion bars, pure, unalloyed gold isn't a better investment per se. Purity is just a matter of esthetic preference for some. As with silver, what matters most in gold bullion investing is how many ounces you can get for your money – not the particular form or mint "brand."

About the Author:

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named "Best in the USA" by an independent global ratings group. A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals' brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.